BlackRock

‘It’s So Early’: How Solana Is Competing With Ethereum for Institutional Interest

Solana has a reputation as a memecoin hub, but financial institutions are looking to build on the network.

By Tom CarrerasNov 5, 2024

BlackRock's Entry Into Crypto Matters More Than U.S. Election, QCP Capital's Darius Sit Says

BlackRock CEO Larry Fink appearing on CNBC means more to QCP's founder and chief investment officer rather than presidential candidates promoting crypto.

By Sam ReynoldsOct 31, 2024

Crypto Stocks MicroStrategy, Coinbase and Marathon Post Just Modest Gains as Bitcoin Eyes Record High

A notable outperformer was bitcoin miner Bitfarms, which nominated a new board member amid its proxy battle with Riot Platforms.

By Tom CarrerasOct 29, 2024

Tokenized Treasuries Like Blackrock's BUIDL Will Challenge Stablecoins But Won't Fully Replace Them: JPMorgan

Tokens such as BUIDL are at a regulatory disadvantage to stablecoins due to their classification as securities, the report said.

By Will CannyOct 25, 2024

U.K. Pension Giant L&G Looks to Enter Crypto's Tokenization Space

London-based L&G, which has $1.5 trillion in assets, is evaluating ways to join other big traditional players like BlackRock, Franklin Templeton and Abrdn that are offering blockchain-based money-market funds and the like.

By Ian Allison, Will CannyOct 21, 2024

CFTC Subcommittee Sends Up Recommendations for Letting Firms Use Tokenized Shares as Collateral: Bloomberg

BlackRock and Franklin Templeton could see tokenized shares of their money-market funds traded as collateral by the end of the year.

By Amitoj SinghOct 3, 2024

Grayscale’s High ETF Fee Keeps the Cash Flowing In Even as Investors Withdraw

Grayscale’s fee revenue from GBTC is nearly five times higher than BlackRock’s from IBIT even after a 50% decline in assets under management.

By James Van StratenOct 2, 2024

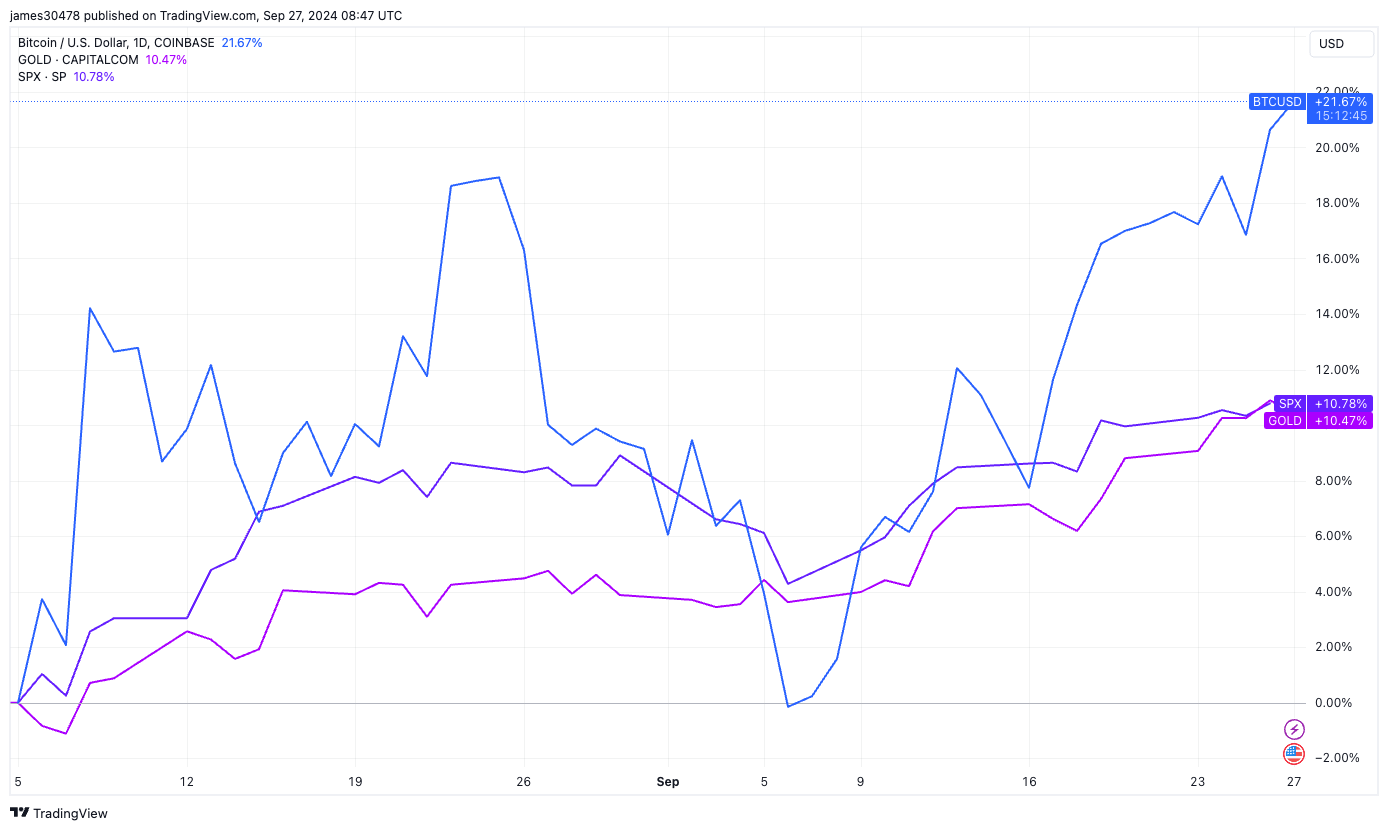

BlackRock Highlights Bitcoin’s Unique Properties as Approved IBIT Options Could Cement Risk-Off Status

BlackRock's latest report shows that bitcoin has a very low correlation to U.S. equities on a trailing six-month basis.

By James Van StratenSep 27, 2024

BlackRock Bitcoin ETF Options to Set Stage for GameStop-Like 'Gamma Squeeze' Rally, Bitwise Predicts

Last week, the U.S. Securities and Exchange Commission's (SEC) approved the list of of physically settled options tied to BlackRock's spot Bitcoin ETF, the iShares Bitcoin Trust (IBIT).

By Omkar GodboleSep 23, 2024

Brian Armstrong, ETF Experts Shoot Down 'Paper Bitcoin' Rumors

Some online chatter has suggested Coinbase is issuing bitcoin IOUs to BlackRock, which ultimately was manipulating the price of crypto lower.

By Helene BraunSep 17, 2024