Federal Reserve

The Fed Is the Wrong Regulator for Stablecoins

The U.S. central bank would be conflicted overseeing stablecoins, because they compete with the Fed's payments infrastructure and with potential CBDCs.

By Jennifer J. Schulp, Jack SoloweyOct 23, 2024

U.S. September CPI Disappoints, Rising a Faster Than Expected 0.2%

Bitcoin fell, with the news likely to further raise the odds of a Fed pause at the its next policy meeting in November.

By Stephen AlpherOct 10, 2024

Uptrend in Bitcoin's Dominance Rate Threatened by Fed Rate Cut Cycle, Crypto Asset Manager Says

Per SwissOne Capital, the BTC dominance rate and the U.S. interest are positively correlated.

By Omkar GodboleOct 10, 2024

Bitcoin Dips Below $61K, Ether Slips 3% as Some PlusToken China Ponzi-Related Coins Moved to Exchanges

One observer noted 7,000 PlusToken-related ETH transferred to crypto exchanges on Wednesday, raising concerns about potential selling pressure.

By Krisztian SandorOct 9, 2024

The Notion of Aggressively Dovish Fed Fades as U.S. Inflation Report Looms

Bitcoin is struggling to gain upside traction as a hawkish rethink of Fed interest-rate policy raises Treasury yields and strengthens the dollar.

By Omkar GodboleOct 7, 2024

U.S. Added Blowout 254K Jobs in September, Unemployment Rate Dips to 4.1%

The news seems likely to further cement ideas that the Fed will trim rates just 25 basis points at its next policy meeting in November.

By Stephen Alpher, James Van Straten, Krisztian SandorOct 4, 2024

Key Indicators Challenge Fed's 'Normalization' Rate Cut That Torched Bitcoin Rally

The post-Fed risk-on rally supports the normalization narrative, but some indicators disagree, suggesting caution to bulls.

By Omkar GodboleSep 26, 2024

The Fed Pivot is Finally Here

Last week, the Fed cut its federal funds target rate by 50 bps to 5.00% p.a. (upper limit) which could have strong implications for the crypto community, says Andre Dragosh, head of research Europe, Bitwise.

By André DragoschSep 25, 2024

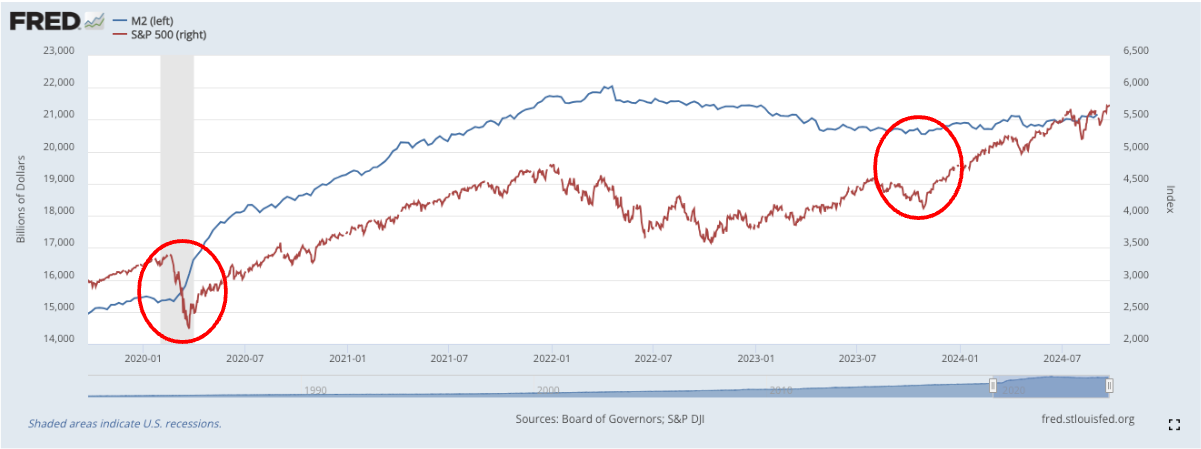

U.S. M2 Money Supply Approaches New Highs as Financial Assets Reach Record Levels

Expansionary policies by not just the Fed, but other global central banks, appear to be fueling asset price appreciation.

By James Van StratenSep 25, 2024

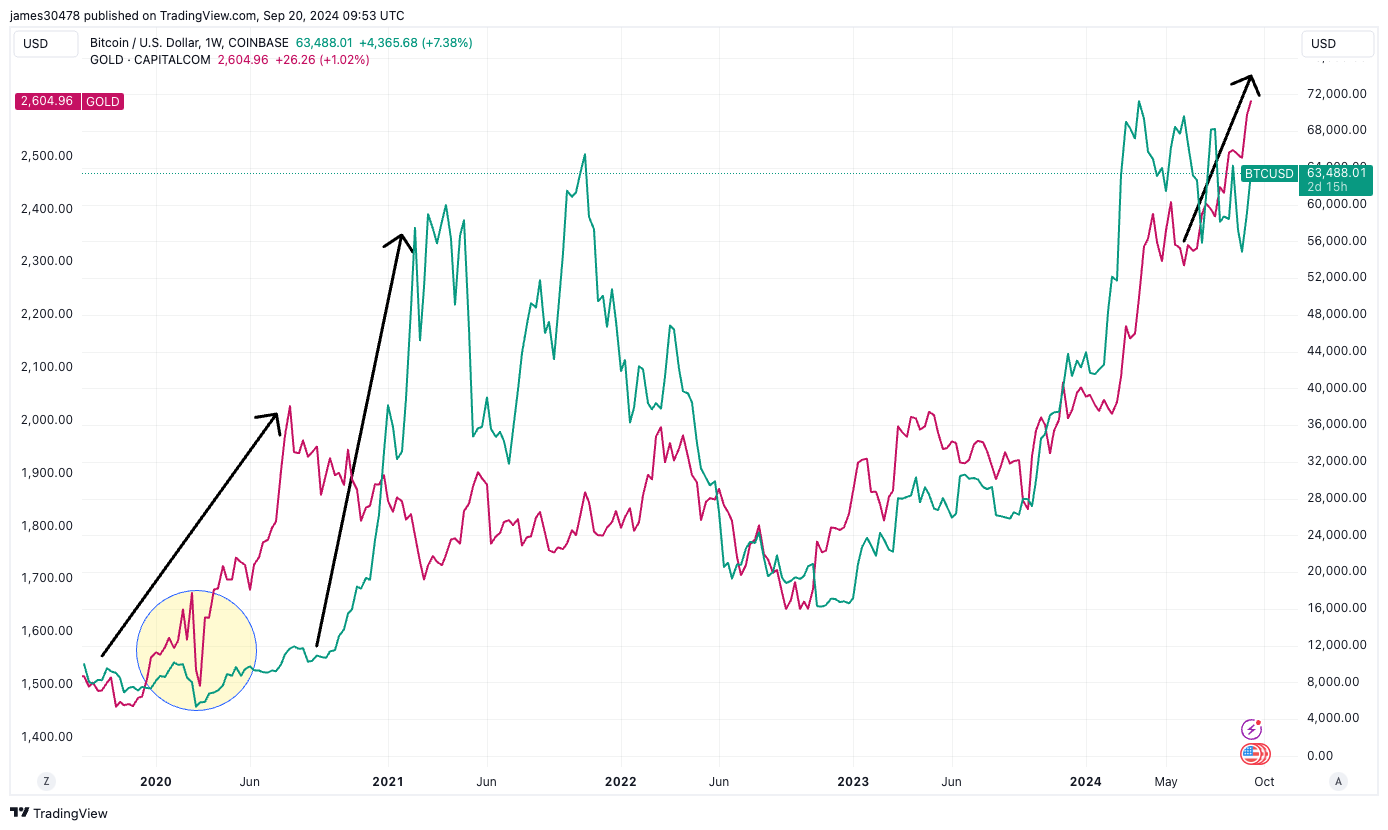

Bitcoin, Gold May Be Sensing Monetary Debasement as Records Beckon

With both assets leading the market, here's a closer look at the factors driving their remarkable performance.

By James Van StratenSep 20, 2024