Real World Assets

Real-World Assets Build on Solana as Ondo Finance Expands Tokenized Treasury Offering

The combined market cap of tokenized Treasuries mushroomed to over $760 million from $110 million earlier this year, according to RWA.xyz data.

By Krisztian SandorDec 19, 2023

The Year of Institutional Investment in Real World Assets

The rise of secure, regulated tech will bring a wealth of financial institutions into blockchain in the coming years, BitGo Director Sanchit Pande writes for Crypto 2024.

By Sanchit PandeDec 18, 2023

Coinbase to Bring TradFi Assets On-Chain With New Platform Built on Base Under Abu Dhabi Regulator's Oversight

"Project Diamond" lets institutions create and trade digital native versions of financial instruments such as debt using Base in a regulated manner.

By Krisztian SandorDec 12, 2023

Tokenization of RWAs Gets Push in Europe as AXA, Generali Buys SocGen's Green Bonds on Ethereum

SocGen said tokenized bonds provide greater transparency and traceability, as well as speedier transactions and settlements.

By Krisztian SandorDec 4, 2023

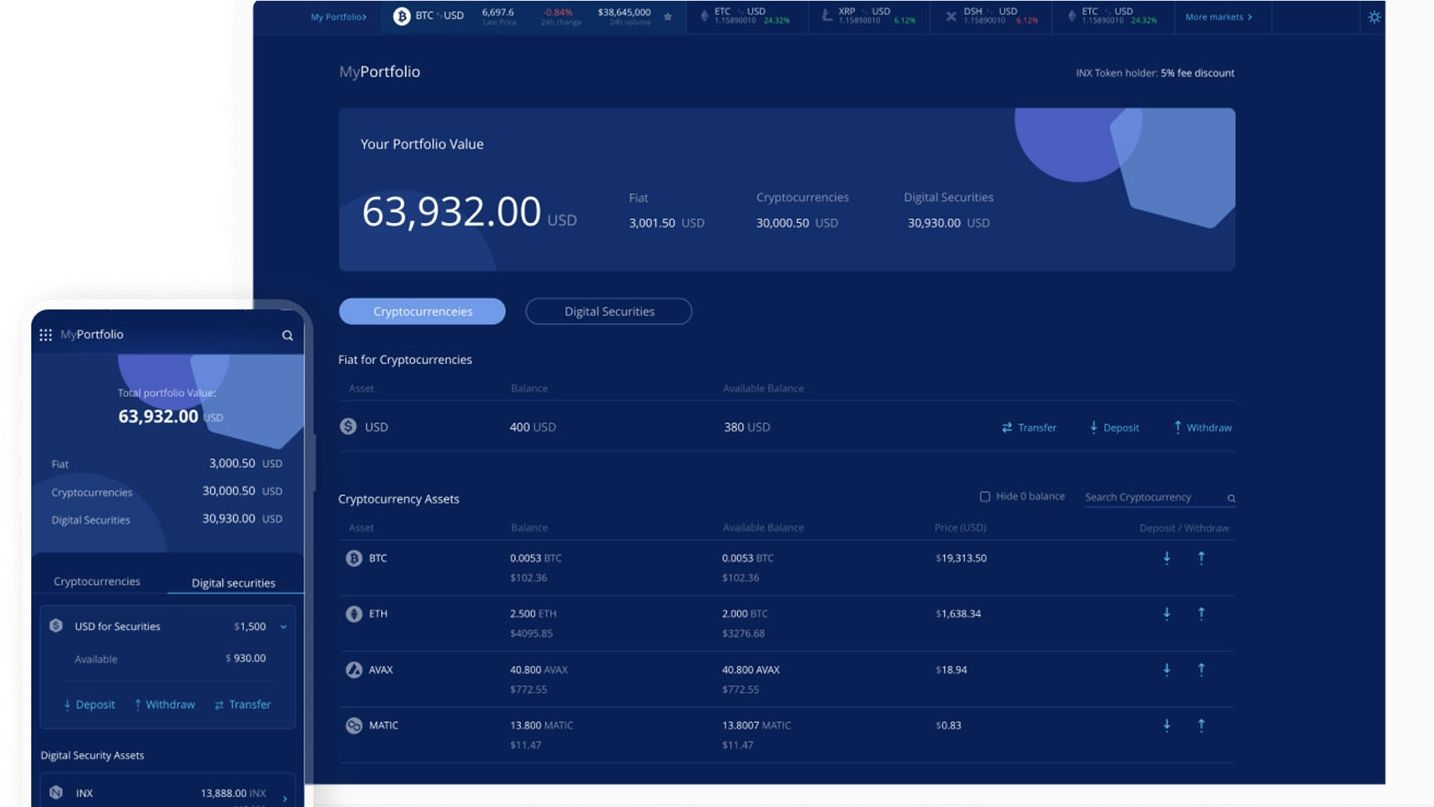

Republic to List Profit-Sharing Digital Security Token on INX Next Week

The token will be accessible to retail investors who don’t usually have the opportunity to invest in private companies without large checks and accreditation.

By Lyllah LedesmaNov 29, 2023

Tokenization and Real-World Assets Take Center Stage

Blue-chip institutions including Goldman Sachs and J.P. Morgan are trialing digital asset offerings, seeking cost savings and efficiencies.

By Peter GaffneyNov 22, 2023

Crypto Industry Goes Nuclear With Uranium-Linked Tokens

The Uranium3o8 tokens are backed by uranium from the publicly-listed Canadian exploration and development firm Madison Metals.

By Krisztian Sandor, Danny NelsonNov 21, 2023

Republic's Profit-Sharing Token on Avalanche Will Pay Investors VC Dividends

The latest entrant to crypto's RWA craze gives upside on Republic's venture portfolio.

By Danny NelsonNov 17, 2023

Tokenization Firm Superstate Gets $14M Investment to Bring Traditional Funds On-Chain

The company has earmarked the funds for team expansion, creating private funds for institutional investors and crafting a framework for tokenized public funds that U.S. clients can access.

By Krisztian SandorNov 15, 2023

Blockchain Startup Kinto Plans 'First KYC'd' Ethereum Layer-2 Network After Raising $5M

Ethereum layer 2 Kinto network features native know-your-customer (KYC) checks and investor accreditation mechanism to help onboard regulated financial institutions.

By Krisztian SandorNov 15, 2023