Real World Assets

RWA Platform Re Debuts Tokenized Reinsurance Fund on Avalanche with $15M Commitment from Nexus Mutual

The company aims to broaden access to the $1 trillion reinsurance industry, making it more efficient and transparent with blockchain technology.

By Krisztian SandorMay 14, 2024

Solana-Based Marketplace AgriDex Raises $5M to Tokenize Agricultural Industry

AgriDex brings agricultural commodities onto the blockchain by allowing crops to be bought on its marketplace with finalized deals backed by non-fungible tokens (NFTs).

By Jamie CrawleyMay 9, 2024

BlackRock, Ondo, Superstate: The Biggest Movers in the RWA Sector in Q1

Catching up on the biggest news from the real-world asset space.

By Ryan RodenbaughMay 7, 2024

Crypto for Advisors: Digital Asset Custody’s Future

Once they reach a certain level of sophistication, there’s a clear trend for Web3 asset holders to transition their digital asset wealth to self-custody.

By Sarah Morton, Colton DillionMay 2, 2024

Tokenized Private-Credit Platform Untangled Opens Its First USDC Lending Pool on Celo

Private credit has been at the forefront of crypto's asset tokenization trend with over $600 million outstanding in on-chain assets.

By Krisztian SandorMay 2, 2024

TradFi Veterans Pitch Tokenized Asset Marketplace With Eyes on U.S. Regulatory Approval

Ironlight, helmed by the former global head of trading of Schroders and Abu Dhabi sovereign wealth fund ADIA with the ex-CEO of TD Bank as an adviser, aims to be a premier tokenization, listing and trading ecosystem for real-world assets targeting big investors.

By Krisztian SandorMay 2, 2024

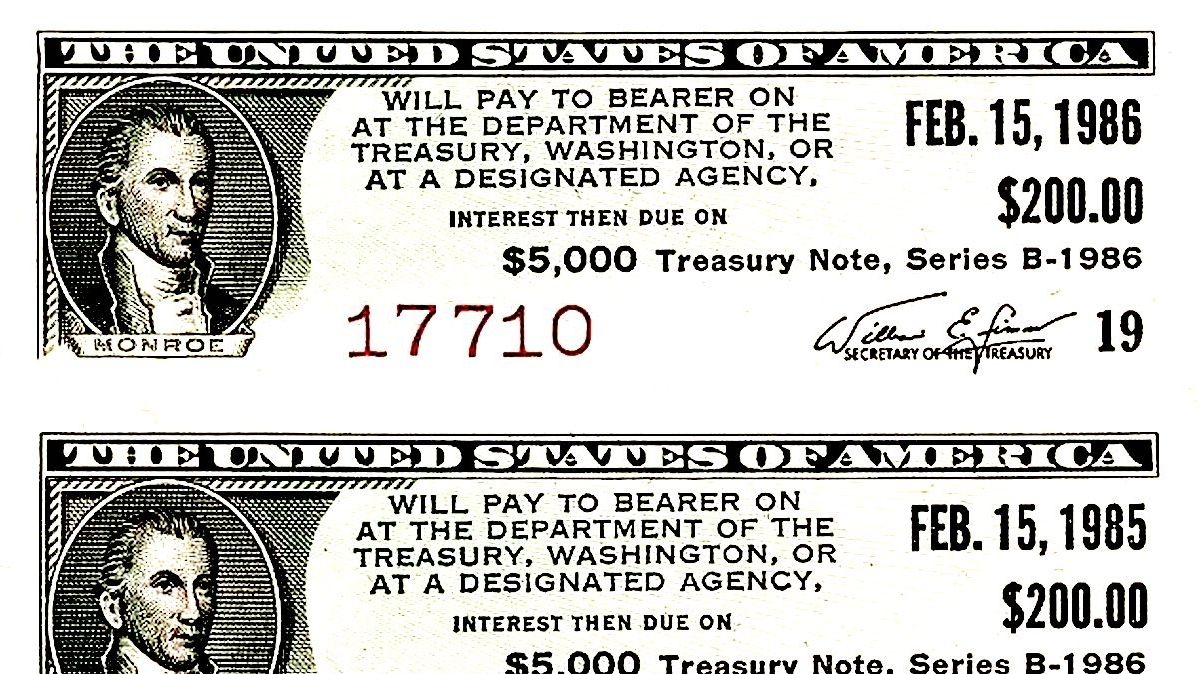

BlackRock's BUIDL Becomes Largest Tokenized Treasury Fund Hitting $375M, Toppling Franklin Templeton's

BlackRock's first tokenized offering, created with Securitize, has captured almost 30% of the $1.3 billion tokenized Treasury market in just six weeks.

By Krisztian SandorApr 30, 2024

Tokenized Asset Issuer Backed Raises $9.5M as Crypto's RWA Race Heats Up

The fundraising will help accelerate Backed's private tokenization offering and onboard asset managers to blockchains, the company said.

By Krisztian SandorApr 30, 2024

Why Asset Tokenization Is Inevitable

On-chain real-world assets and the integration of wallet infrastructure will replace intermediaries and become standard in the modern asset management lifecycle, says Mehdi Brahimi, head of institutional business at L1.

By Mehdi Brahimi, Miguel KudryApr 24, 2024

Crypto Exchange Woo X Claims a First With Tokenized Treasury Bills for Retail Investors

The Woo X RWA Earn Vaults have been built in partnership with institutional tokenization firm OpenTrade.

By Ian AllisonApr 22, 2024