Options

Bitcoin Indicator Suggests Potential for Leverage Washout

A ratio related to bitcoin futures and the volatility of options has more than doubled this year, signaling outsized levels of leverage and speculation.

By Omkar GodboleFeb 26, 2024

Ether's $3K Breakout Partly Fueled by Dealer Hedging, Analyst Says

Options dealers likely bought ETH in spot/futures market to hedge their short positions in call options, adding to bullish momentum, BloFin's Griffin Ardern said.

By Omkar GodboleFeb 22, 2024

Bitcoin Options Trader Takes $20M Bet to Hedge Against Prices Dropping to $47K

The strategy provides a hedge against a potential bitcoin price pullback to $47,000 and costs over $20 million, according to crypto block trading service provider Greeks.Live.

By Omkar GodboleFeb 20, 2024

Crypto Traders See 20% Chance of Bitcoin Topping $70K by April End: DeFi Options Marketplace Lyra

Bitcoin has rallied 35% in three weeks, with mining reward halving due in April.

By Omkar GodboleFeb 16, 2024

Bitcoin Traders Scoop Up Options Bets at $65K and Higher

The bullish flow is reminiscent of the 2020-2021 bull market when traders consistently snapped up bitcoin calls at levels well above the going market rate.

By Omkar GodboleFeb 13, 2024

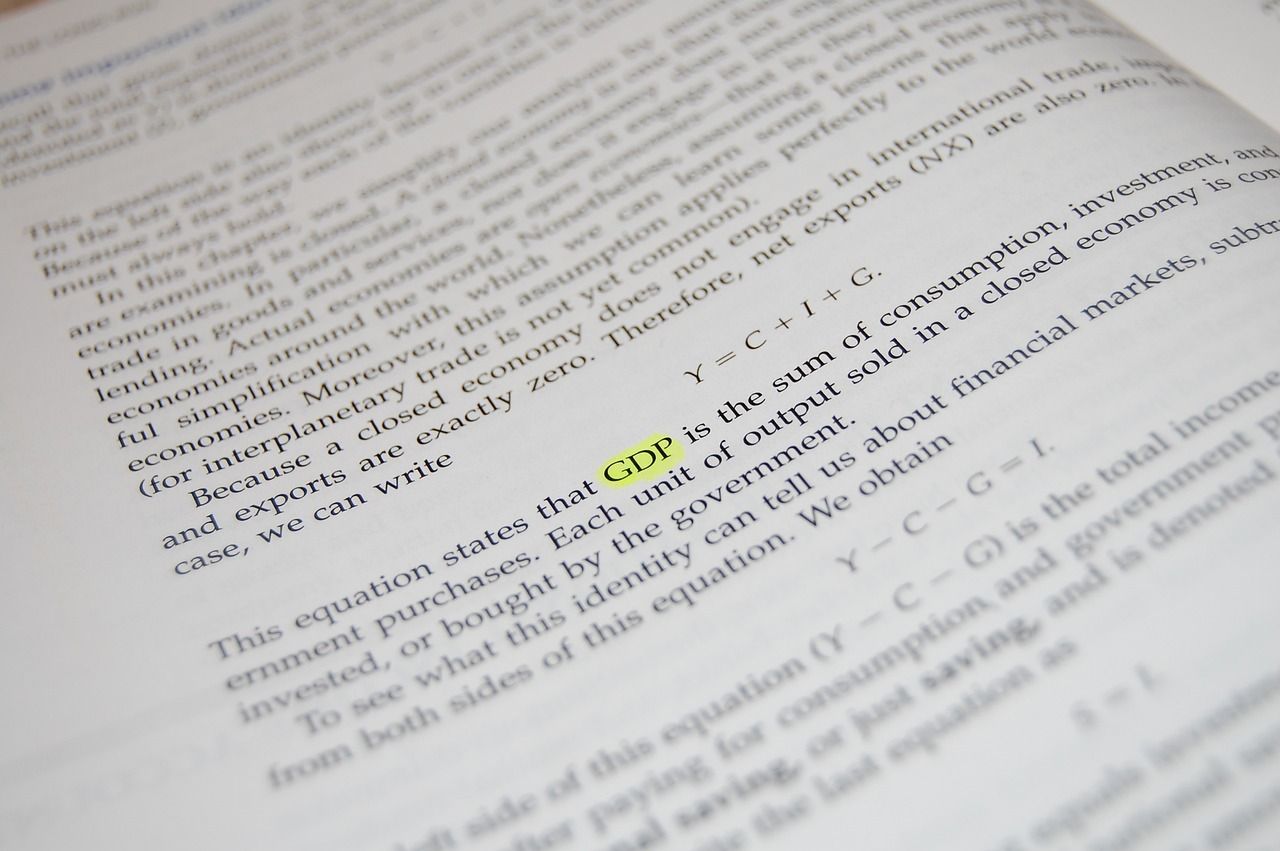

Bitcoin Holds Above $40K Ahead of U.S. GDP, $5.8B Crypto Options Expiry

Traders have scaled back bets of aggressive rate cuts by the Federal Reserve ahead of the U.S. GDP report.

By Omkar GodboleJan 25, 2024

Ether Options Out of Sync With Bullish Sentiment on Street

The way ether options are priced suggests investor preference for bets that prices will fall, contradicting the bullish outlook presented by some analysts.

By Omkar GodboleJan 25, 2024

Bullish Bitcoin Bets Rise as Implied Volatility Slides

Some traders bought bitcoin calls at strikes $45,000 and $46,000 during Thursday's U.S. trading hours, according to over-the-counter institutional cryptocurrency trading network Paradigm.

By Omkar GodboleJan 19, 2024

Bitcoin Traders Seek Protection From Price Declines as ETF Deadline Looms: Deribit

Puts are overbought and calls [are] being sold, Deribit's CCO Luuk Strijers told CoinDesk, noting the decline in the bitcoin implied volatility index.

By Omkar GodboleJan 10, 2024

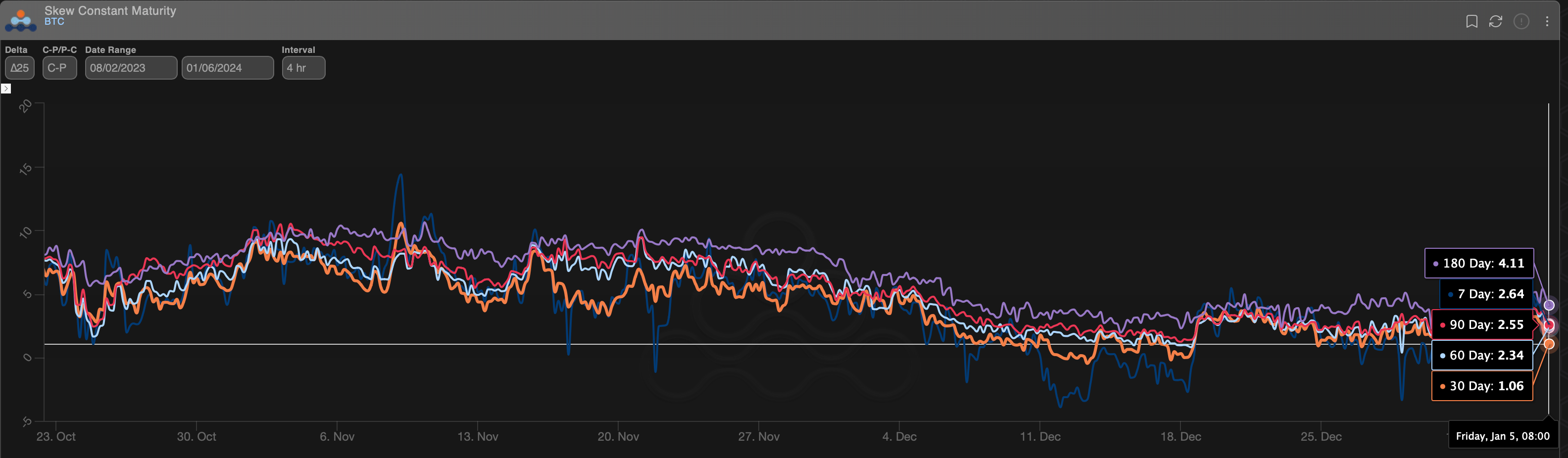

Bitcoin Traders Pare Bullish Bias as Spot ETF Deadline Nears

BTC calls trade at a much lower premium to puts than in November, as some analysts expect the cryptocurrency to decline following the anticipated debut of spot ETFs in the U.S.

By Omkar GodboleJan 5, 2024