Options

A Record $11B Crypto Options Expiry Looms as BTC Shows Little Volatility

The expiry is Deribit's largest so far and a record of almost $5 billion of options will expire in the money.

By Omkar GodboleDec 28, 2023

U.S. CFTC Approves Bitcoin Futures Platform Bitnomial's Derivatives Clearing Application

The commissioners discussed issues like conflict of interest before ultimately voting in favor of the margined bitcoin futures company.

By Nikhilesh DeDec 13, 2023

Why 2023 Is Like 2020 and Bitcoin Is Set to Head Towards $50k

Crypto derivatives show bullish positioning but are not over-extended by historical norms. That’s good news for the whole crypto market.

By Greg MagadiniDec 13, 2023

Bitcoin, Ether Options' Value on Deribit Reaches Record High of $23B

Increased interest in the three-dimensional options trading suggests an influx of sophisticated traders in the crypto market.

By Omkar GodboleDec 8, 2023

Crypto Traders Load Up on Bitcoin Topside Option Plays After Binance's Guilty Plea

We have seen interest in loading up more topside with strong demand for the March 2024 expiry calls, one OTC desk said.

By Omkar GodboleNov 22, 2023

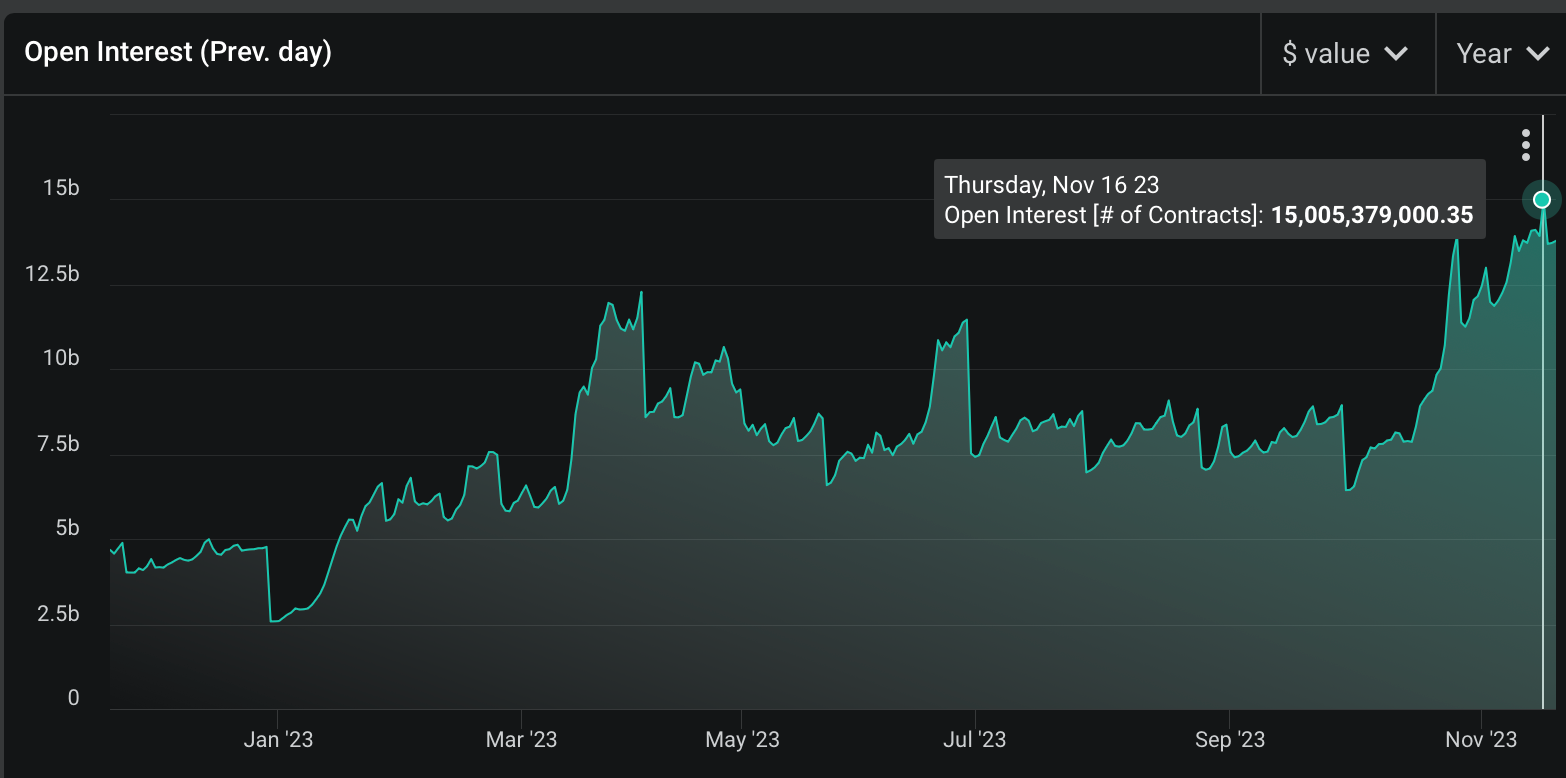

Bitcoin Options Open Interest Climbs to Record $15B on Crypto Exchange Deribit

The notional open interest in BTC options listed on Deribit rose to a record $15 billion last week as traders scrambled to take bullish exposure.

By Omkar GodboleNov 20, 2023

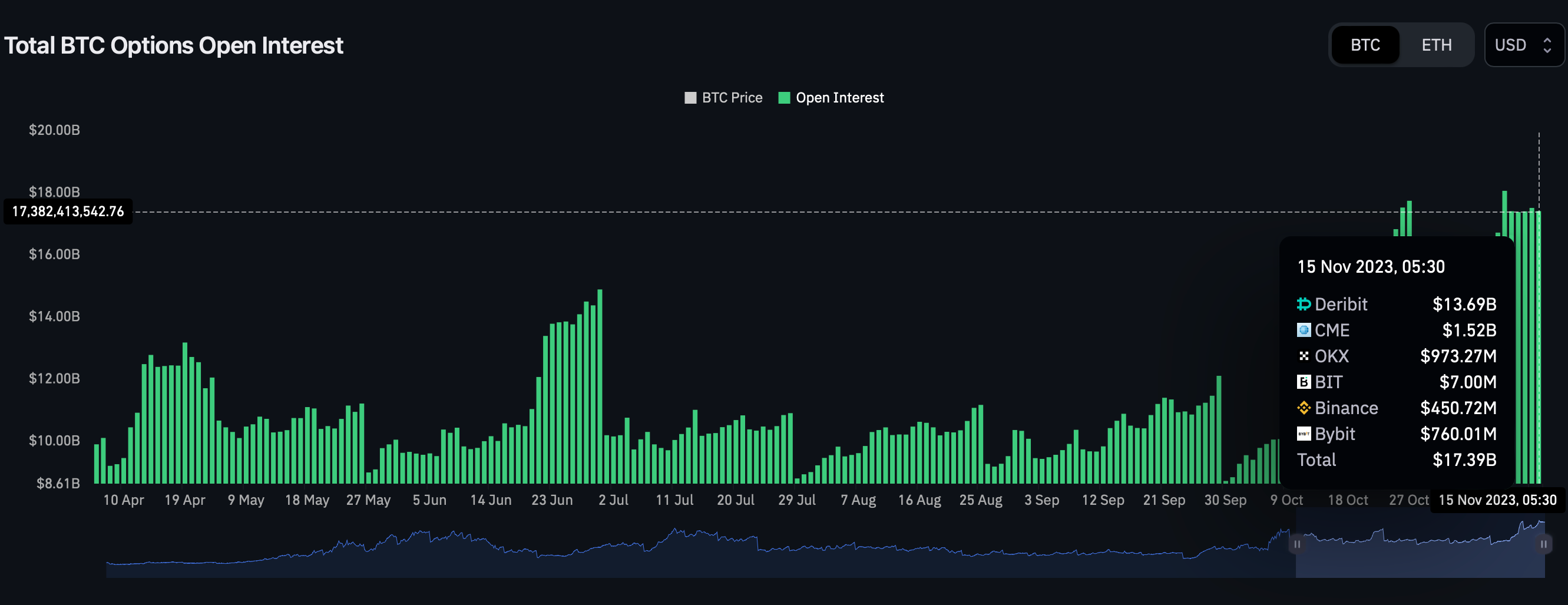

Bitcoin's Options Market Has Overtaken Its Futures Market in a Sign of Growing Sophistication

The notional open interest in BTC options worldwide stood at $17.5 billion at press time, while open interest in the futures market was $15.84 billion.

By Omkar GodboleNov 15, 2023

Bitcoin Call Skew Hints at Further Price Rise as Spot ETF Optimism Energizes BTC

The one-month call-put skew has risen above 10%, indicating a strongest bullish bias in 31 months.

By Omkar GodboleNov 9, 2023

Bitcoin Put Options, Which Offer Downside Protection, Look Unusually Cheap. Will the Situation Last?

Historically, puts have seldom traded at cheaper valuations for a prolonged period.

By Omkar GodboleNov 2, 2023

Bitcoin Could Go Crazy Above $36K, Options Data Suggests

Bitcoin options dealers or market makers are likely to trade in the direction of the market above $36,000, accelerating price gains.

By Omkar GodboleNov 1, 2023